ITS Transit Standards Professional Capacity Building Program

Module 12: Electronic Fare Payment/Advanced Payment Systems: Open Payments

HTML of the PowerPoint Presentation

(Note: This document has been converted from a PowerPoint presentation to 508-compliant HTML. The formatting has been adjusted for 508 compliance, but all the original text content is included, plus additional text descriptions for the images, photos and/or diagrams have been provided below.)

Slide 1:

(Extended Text Description: Welcome - Graphic image of introductory slide. A large dark blue rectangle with a wide, light grid pattern at the top half and bands of dark and lighter blue bands below. There is a white square ITS logo box with words "Standards ITS Training - Transit" in green and blue on the middle left side. The word "Welcome" in white is to the right of the logo. Under the logo box is the logo for the U.S. Department of Transportation, Office of the Assistant Secretary for Research and Technology.)

Slide 2:

(Extended Text Description: Title slide contain a blurred image of a bus with the text "Module 12 - Electronic Fare Payment / Advanced Payment Systems: Open Payments Acceptance" superimposed on top of that image. The contactless symbol, a graphic showing a card toward four curved lines representing radio waves within an oval, is also superimposed on the bus image along with a stylized image of a credit card. The bus image was provided under permission from the Rogue Valley Transit District (RVTD) in Medford, Oregon. The contactless symbol was provided under license from EMVCo.)

Slide 3:

Instructor

Gary B. Yamamura

Principal Consultant

Three Point Consulting, Inc.

Slide 4:

Learning Objectives

- Define the stakeholders, terminology, standards, specifications, and regulations associated with the acceptance of Open Payments

- Explain the three main options for implementing Open Payments acceptance and their impacts on agency operations and systems

- Analyze the benefits, risks, and costs of Open Payments acceptance in support of the procurement and implementation of an Open Payments acceptance solution

Slide 5:

Learning Objective 1

- Stakeholders, terminology, standards, specifications, and regulations

Slide 6:

Understand the roles and responsibilities of the key stakeholders and their influence on Open Payment implementations

Slide 7:

Open Payments Acceptance

The term Open Payments refers to the acceptance of bank-issued, contactless

- Debit,

- Credit, and

- Prepaid debit cards ("bankcards") for payment of fares at transit points of entry

Contactless bankcards may be:

- Traditional, credit card-sized pieces of plastic

- A mobile device that stores the card data (or an electronic token of that data) and transmits it via radio waves

Image provided under license from Thinkstock®

Slide 8:

Key Terms and Abbreviations

- Account-based System

- Authentication

- Authorization

- Chargeback

- Contactless Bankcard

- Electronic Fare Payment System (EFPS)

- Fare Capping

- Merchant Fees

- Mobile Payment

- Pay As You Go (PAYG)

Image provided under license from Microsoft®

Slide 9:

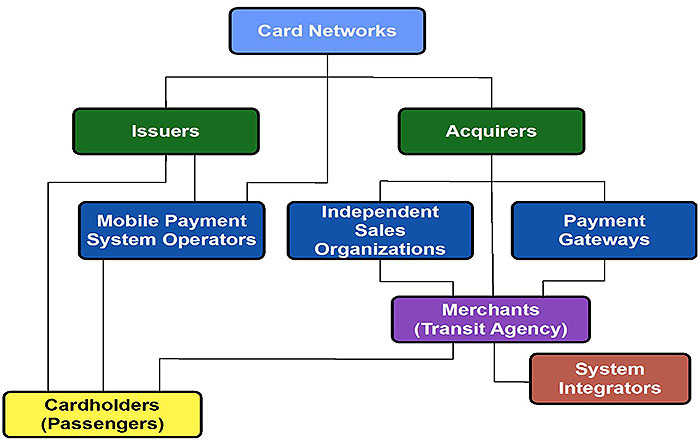

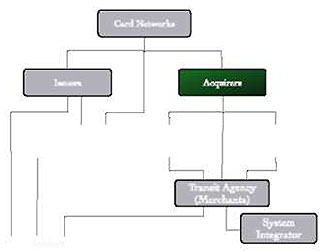

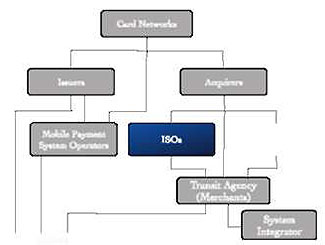

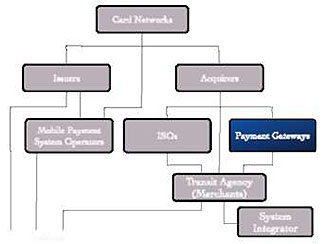

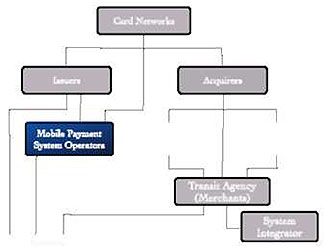

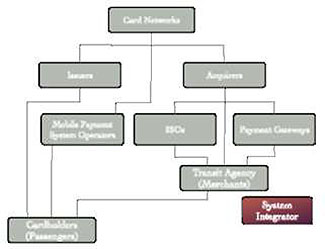

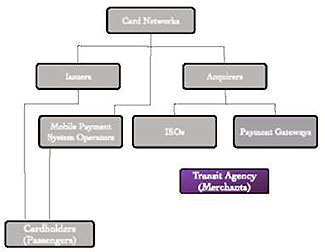

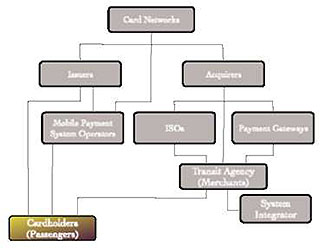

Stakeholders

(Extended Text Description: This slide, entitled Stakeholders, has a graphic showing an organization chart with nine (9) different colored boxes that represent the stakeholder groups that control and/or support open payments acceptance. The boxes are labeled, from top to bottom, left to right: Card Networks, Issuers, Acquirers, Mobile Payment System Operators, Independent Sales Organizations, Payment Gateways, Merchant (Transit Agency), System Integrator, and Cardholders (Passengers).)

Slide 10:

Card Networks

Roles and Responsibilities

- Create and promote global brand recognition

- Establish and enforce network operating rules

- Provide a global network for transaction routing

- Support and promote the use of payment-related standards and specifications

Slide 11:

Issuer

Roles and Responsibilities

- Cardholder acquisition and servicing

- Card branding and distribution

- Account management

- Card authentication

- Cardholder verification

- Payment authorization and settlement

- Fraud prevention and detection

- Chargeback processing

- Debt collection (for credit cards)

Examples

- Citibank

- Chase Bank

Slide 12:

Acquirer

Roles and Responsibilities

- Payment transaction processing ("acquiring") on behalf of merchants

- Facilitates authorization and settlement processing

- Acts as the interface to the card networks

- Processes chargebacks

- Accepts financial liability for the merchant

- Enforces Payment Card Industry Data Security Standard ("PCI") compliance

Examples

- First Data Corporation

- TSYS

Slide 13:

ISO

Independent Sales Organization

Roles and Responsibilities

- Provides team for door-to-door sales on behalf of an acquirer

- May provide added-value services such as enhanced reporting or custom software for point of sale (POS) terminals

- Assumes primary responsibility for merchant servicing

Examples

- North American Bancard LLC

- Harbortouch Payments LLC

Slide 14:

Payment Gateway

Roles and Responsibilities

- Operates a processing system for bankcard payments

- Acts as an intermediary between the acquirer and the merchant

- Provides an open interface to its processing system to simplify and shorten the systems integration effort

- Primarily focuses on online (web-based) payments

Examples

- Authorize.Net

- PayPal

- SecurePay

Slide 15:

Mobile Payment System Operator

Roles and Responsibilities

- Develops and operates a mobile payment system

- Recruits issuers and enables integration with their systems

- Offers a mobile app and/or mobile wallet to cardholders that enables use of the mobile payment system

- Facilitates virtual card account setup by cardholders

- Performs front end cardholder identification (e.g. biometrics)

- Provides front end card data security (e.g. tokenization)

Examples

- Apple (Apple Pay)

- Google (Android Pay)

Image provided under license from Thinkstock®

Slide 16:

System Integrator

Roles and Responsibilities

- Design, development, and installation of EFPS

- Establishes back end connection to Acquirer system

-

Ensures that equipment and software are compliant with:

- EMV specifications

- Card network specifications

- PCI DSS

- Acquirer requirements

- Agency requirements

Examples

- Cubic Transportation Systems, Inc.

- Xerox

Slide 17:

Merchant (Transit Agency)

Roles and Responsibilities

- "Merchant of Record"

- Accepts financial liability for chargebacks

-

Ongoing compliance with:

- EMV specifications

- Card network specifications

- PCI DSS

- Acquirer requirements

- Disputing or accepting chargebacks

Examples

- Chicago Transit Authority (CTA)

- Utah Transit Authority (UTA)

Slide 18:

Cardholder

Roles and Responsibilities

- Account ownership

- Card (or mobile device) ownership and usage

-

Adherence to

- Issuer rules

- Agency fare policies

- Fare payments using card or mobile device

- Debt repayment (for credit cards)

Slide 19:

Recognize the difference between standards, specifications and regulations and the importance of these documents in defining, procuring, implementing and maintaining an EFP system with Open Payments acceptance

Slide 20:

Standards

Definition

A document that defines processes, procedures and/or technology for the common and repeated use of a system that has been established by consensus and approved by a recognized organization.

International standards are formally approved and maintained by the International Standards Organization (ISO) and/or the International Electrotechnical Commission (IEC).

Key standards

- Payment Card Industry Data Security Standard (PCI DSS)

- ISO/IEC 14443

- ISO/IEC 8583

- ISO/IEC 18092

Slide 21:

Specifications

Definition

A detailed description of the performance requirements, dimensions, materials, and interfaces for the development and/or use of a technology or process.

Specifications are typically defined and maintained by the party that offers the technology or process and may be changed at any time.

Key specifications

- EMV (Europay, MasterCard, Visa)

- Visa payWave

- MasterCard PayPass

- American Express ExpressPay

- Discover ZIP

Slide 22:

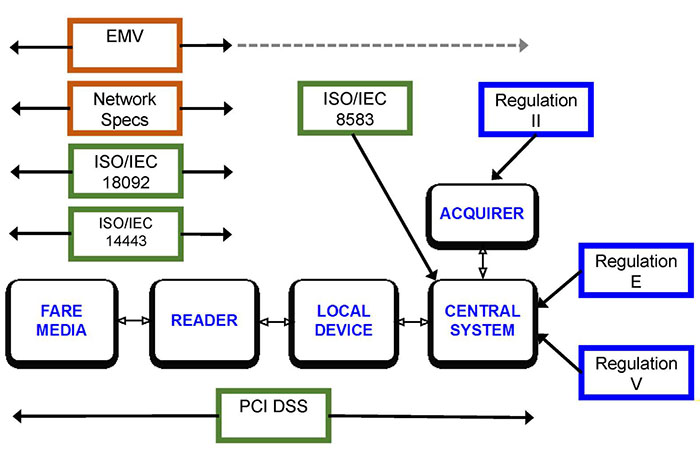

Scope of Impact

(Extended Text Description: This figure has a graphic with five square boxes with rounded corners. Those five boxes represent the major components of an Electronic Fare Payment System and are labeled from top to bottom, left to right: Acquirer, Fare Media, Reader, Local Device and Central System. Above, below and to the right of that graphic are colored boxes that identify the international standards, federal regulations, and specifications that are applicable to the acceptance of open payments. Those boxes are labeled, from top to bottom, left to right: EMV, Network Specs, ISO/IEC 8583, Regulation II, ISO/IEC 18092, ISO/IEC 14443, Regulation E, Regulation V, and PCI DSS. There are arrows leading from the second sets of boxes outward to indicate the component(s) that is/are potentially covered by the standard, regulation, or specification.)

Slide 23:

Payment Card Industry Data Security Standard (PCI DSS)

- Defines bankcard data security rules

- Adherence mandated for all merchants by card network rules

- Maintained by the PCI Security Council

Slide 24:

ISO/IEC 14443

Contactless integrated circuit cards -Proximity cards

- Widely-adopted standard for short range communications between cards and readers

- Applies to physical and virtual cards

- Incorporated in all of the leading contactless bankcard specifications

Slide 25:

ISO/IEC 8583

Financial transaction card originated messages, Interchange message specifications

- Defines the format and content of electronic bankcard transaction messages

Slide 26:

ISO/IEC 18092

Information Technology, Telecommunications and Information Exchange between systems, Near Field Communication, Interface, and Protocol (NFCIP-1)

- Better known as near field communication (NFC)

- Defines methods to enable short-range communications - particularly between mobile phones and readers

- Uses ISO/IEC 14443 communication protocols

- See also: ISO/IEC 21481

Slide 27:

EMV

Europay MasterCard, Visa Specifications

- Specifications for chip-based bankcards and merchant payment terminals and systems

- Widely-implemented in Europe, Asia, Latin America, and Canada

- Includes requirements for contact and contactless cards

- Nationwide adoption by U.S. initiated in 2011

Slide 28:

Card Network Contactless Card Specifications

- Requirements for contactless bankcards, equipment and transactions

- Unique specification for each network

-

Leading card network programs

- Visa payWave

- MasterCard PayPass

- American Express ExpressPay

- Discover ZIP

- May change with little advance notice

- Also applicable to mobile payments

Slide 29:

Card Network Operating Rules

- Define rules for acceptance of cards and mobile payments linked to cards

- Unique rules for each network

- Updated semi-annually

- Not true specifications per se

Slide 30:

Regulations

In the U.S., various federal regulations impact acceptance of bankcard transactions. These include:

- E - Electronic Funds Transfer Act

- II - Debit Card Interchange Fees and Routing

- V - Fair and Accurate Credit Transactions Act

Slide 31:

Regulation E

Electronic Fund Transfer Act

- Protects individual consumers engaging in electronic fund transfers

-

Defines requirements for:

- Receipts

- Periodic statements

- Procedures for resolving errors

- Creates definitions for "gift" and "reloadable" cards

-

Establishes rules for:

- Assessing fees

- Expiration of funds

- Cardholder disclosures

Slide 32:

Regulation II

Debit Card Interchange Fees and Routing

- Embodiment of the "Durbin Amendment"

- Limits interchange fees to 0.5% of the payment amount plus $0.21 per transaction

- Allows $0.01 additional interchange for fraud-prevention

- Prohibits exclusive agreements for transaction routing and processing

- Exempts issuers with less than $10B in total assets

Slide 33:

Regulation V

Fair and Accurate Transactions Act

- Requires the truncation of card number and prohibits the inclusion of card expiration dates on transaction receipts

Slide 34:

Slide 35:

Question

Which of the following is NOT a key stakeholder for an EFPS that accepts Open Payments?

Answer Choices

- Issuer

- Card Network

- POS Terminal Manufacturer

- Cardholder

Slide 36:

Review of Answers

a) Issuer

a) Issuer

Incorrect. The issuer provides cards and card accounts for use in an EFPS system that accepts open payments.

b) Card Network

b) Card Network

Incorrect. The card network provides a global platform that facilitates open payments.

c) POS Terminal Manufacturer

c) POS Terminal Manufacturer

Correct! Although the POS Terminal Manufacturer may make equipment for open payment processing, this equipment can be supplied by a variety of different providers.

d) Cardholder

d) Cardholder

Incorrect. The Cardholders carry and use contactless bankcards in an EFPS that accepts open payments.

Slide 37:

Learning Objective 2

- Options for Implementing Open Payments acceptance

Slide 38:

Common Benefits

Eliminates need for passengers to:

- Obtain agency-issued fare media

- Buy fare product

- Understand fares or the details of the agency's fare policy

- Carry exact change

- Register in advance

- Create an account

Slide 39:

Common Benefits

Reduces agency need for:

- Fare media

-

Fare product sales network

- Ticket vending machines

- Website

- Mobile app

- Retail stores

Image provided under license from Thinkstock®

Slide 40:

Common Benefits

Transfers responsibilities to card issuer

- Card distribution and statements

- Call center (for issues relating to fare payment)

- Dispute handling

- Account management

Slide 41:

Shared Issues

First tap risk

- Every card approved first time

- "Bad" cards identified later and added to negative list

Mitigation strategy:

- Real-time issuer authentication and authorization of card

- Likely to increase first tap transaction time to a few seconds

Slide 42:

Shared Issues

Merchant fees

- 10% or more of fare

Mitigation strategy:

-

Transaction aggregation

Note: May increase exposure to declined payments and fraud

Image provided under license from Thinkstock®

Slide 43:

Shared Issues

Minimal security for offline payments

- Offline approval process bypasses card authentication and transaction authorization processes

Mitigation strategy:

-

Implement real-time issuer authorization

Note: Increased transaction time (2-5 seconds) may not be viable for busy systems

Image provided under license from Thinkstock®

Slide 44:

Lack of cardholder adoption

- Security concerns

- Insufficient contactless bankcard issuance

- Unbanked

Mitigation strategy:

- Agency-issued cards as part of an account-based system

Slide 45:

Shared Issues

Cost of compliance

- Different application for each network

- Specifications may change

Mitigation strategy:

- None. Such costs are unavoidable.

Slide 46:

Shared Issues

Few systems in revenue service

- Most vendors lack experience

- Limited choices for certified equipment

Mitigation strategy:

- None. Without further adoption, revenue service proven vendors and equipment choices will remain limited.

Slide 47:

Shared Issues

Long certification queues

- Type certification required for each network

- Separate EMV certification also required

- Process begins after "final" system is in place

- Changes may trigger new certification

Mitigation strategy:

- Submit EMV and network certification applications as early as possible

Slide 48:

Shared Issues

Title VI conflicts

- Passenger must qualify for bankcard

- Policies cannot favor Open Payment in price or convenience

Mitigation strategy:

- Ensure unbanked passengers have equally convenient and equally-priced options for fare payment

Slide 49:

Pay as You Go

Open Payments accepted only as Pay As You Go (PAYG) fares

- Concept: Passenger pay fares with each tap of contactless bankcard

- Fare Policy: All transactions = full fare

- Process: Fare approved locally by reader, sent to acquirer in batches later

-

Options:

- Payment aggregation to reduce merchant fees

- Agency/Bank cobranded prepaid debit card issued to unbanked passengers

Slide 50:

Pay as You Go

Unique attributes for this method

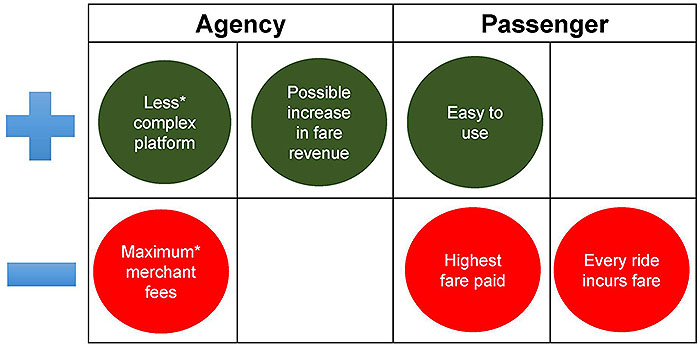

(Extended Text Description: This slide, entitled Pay as You Go, has a chart with four columns. There are three rows in the table and the headings in the first row are Agency and Passenger. Large plus and minus signs appear to the left of the second and third row, respectively. Inside the cells in the table are green and red circles with text that identify attributes associated with the particular type of system being described. The content of the table is as follows:

| Agency | Passenger | |||

|---|---|---|---|---|

| + | Less* complex platform | Possible increase in fare revenue | Easy to use | |

| - | Maximum* merchant fees | Highest fare paid | Every ride incurs fare | |

* When compared to other open payment methods

Slide 51:

PAYG with Fare Capping

Open Payments accepted as PAYG fares with fare capping

- Core Concept: Passengers pay fares with each tap of bankcard but total is capped at daily, weekly, and/or monthly amounts

- Fare Policy: Passengers always pay "fairest fare"

- Process: Fare approved locally by reader, amounts calculated by central system and sent to Acquirer later

-

Options:

- Same as PAYG

Slide 52:

PAYG with Fare Capping

Unique attributes for this method

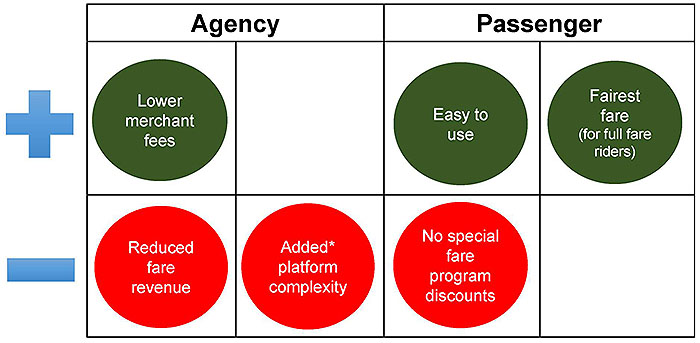

(Extended Text Description: This slide, entitled PAYG with Fare Capping, has a chart with four columns. There are three rows in the table and the headings in the first row are Agency and Passenger. Large plus and minus signs appear to the left of the second and third row, respectively. Inside the cells in the table are green and red circles with text that identify attributes associated with the particular type of system being described. The content of the table is as follows:

| Agency | Passenger | |||

|---|---|---|---|---|

| + | Lower merchant fees | Easy to use | Fairest fare (for full fare riders) | |

| - | Reduced fare revenue | Added* platform complexity | No special fare program discounts | |

* When compared to other Open Payment methods

Slide 53:

PAYG with Account-based System

Open Payments accepted as PAYG fares with option to link bankcards to transit accounts

- Core Concept: Passengers can pay fares with tap of bankcard or can link card to transit account with prepaid fares

- Fare Policy: PAYG plus prepaid fare products, transfers and fare discounts

- Process: Same as PAYG but prepaid fares calculated and approved by central system

-

Options:

- Same as PAYG

Slide 54:

PAYG with Account-based System

Unique attributes for this method

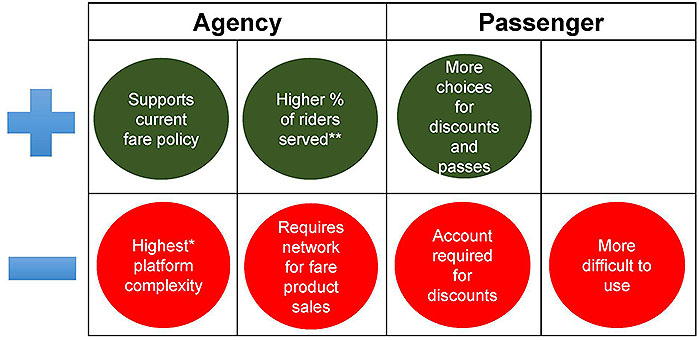

(Extended Text Description: This slide, entitled PAYG with Fare Capping, has a chart with four columns. There are three rows in the table and the headings in the first row are Agency and Passenger. Large plus and minus signs appear to the left of the second and third row, respectively. Inside the cells in the table are green and red circles with text that identify attributes associated with the particular type of system being described. The content of the table is as follows:

| Agency | Passenger | |||

|---|---|---|---|---|

| + | Supports current fare policy | Higher % of riders served** | More choices for discounts and passes | |

| - | Highest* platform complexity | Requires network for fare product sales | Account required for discounts | More difficult to use |

*When compared to other Open Payment methods

** If agency-issued cards provided to unbanked

Slide 55:

Comparison

| PAYG (Only) | PAYG with Fare Capping | PAYG With Account-based System | |

|---|---|---|---|

| Complexity | Lowest | Higher | Highest |

| Ease of Use | Easy | Easy | Complex |

| Fares | No discounts | Fairest | Discounts and passes |

| Fees | Highest | Lower | Depends on usage |

| Revenue | Higher (maybe) | Reduced | Minimal impact |

| Passengers | Banked only* | ||

* If no agency-issued prepaid debit card or transit benefits prepaid debit card available

Slide 56:

Slide 57:

Question

Which of these Open Payments acceptance methods enables passenger purchase and use of prepaid fare products?

Answer Choices

- Pay as You Go

- Pay as You Go + Fare Capping

- Pay as You Go + Account-based

Slide 58:

Review of Answers

a) Pay as You Go

a) Pay as You Go

Incorrect. Using the basic Pay as You Go method, passengers are only able to make full fare payments using their contactless bankcard.

b) Pay as You Go + Fare Capping

b) Pay as You Go + Fare Capping

Incorrect. Like the basic Pay as You Go method, passengers are only able to make full fare payments using their contactless bankcard. The EFPS tracks these payments and, once a predetermined maximum dollar amount has been reached, all subsequent fares using the same card within a set period of time are waived.

c) Pay as You Go + Account-based

c) Pay as You Go + Account-based

Correct! Using this implementation method, passengers may elect to create a virtual account that is linked to a particular contactless bankcard. The passenger can then add stored value and/or a pass product to that account to pay fares.

Slide 59:

Learning Objective 3

- Benefits, risks, and costs of Open Payments acceptance

Slide 60:

Understand and Assess the Costs of Merchant Fees

-

Primary types

- Interchange (paid to card issuer)

- Card Network assessments

- Acquirer fees

-

Fees include two types of components

- Fixed: $0.10 - $0.30 per payment

- Variable: 1.65 to 2.00% of payment amount

-

Interchange varies by:

- Network

- Card and product types

- Payment amount

Image provided under license from Thinkstock®

Slide 61:

Understand and Assess the Costs of Merchant Fees

- Fixed costs are particularly burdensome

- Total may be up to 30% of fares <$2.00

* Excludes Visa Fixed Acquirer Network Fee (FANF). A monthly fee up to $85 assessed for each payment location

Slide 62:

Understand and Assess the Costs of Merchant Fees

Typical Fee Calculation - Credit Card

| Fee Type | Fixed | Variable | Fees on $2 fare |

|---|---|---|---|

| Interchange | $0.0400 | 1.65% | $0.07 |

| Assessments | $0.0223 | 0.13% | $0.03 |

| Acquirer | $0.0500 | 0.20% | $0.06 |

| Total fees: | $0.16 (8.0%) | ||

Example uses Visa interchange rates as of October 2015, Custom Payment Services (CPS) small ticket, credit

Slide 63:

Understand and Assess the Costs of Merchant Fees

Typical Fee Calculation - Debit Card

| Fee Type | Fixed | Variable | Fees on $2 fare |

|---|---|---|---|

| Interchange | $0.2200 | 0.50% | $0.23 |

| Assessments | $0.0223 | 0.13% | $0.03 |

| Acquirer | $0.0500 | 0.20% | $0.06 |

| Total fees: | $0.32 (16%) | ||

Example uses Visa interchange rates as of October 2015, CPS small ticket, debit

Slide 64:

Understand and Assess the Costs of Merchant Fees Aggregation

- Combining two or more payments to Acquirer as one to reduce fixed fees

- May increase financial risk

- Some networks offer specific rules

- Adds complexity to central system

- May increase cardholder disputes

* Excludes Visa FANF. A monthly fee up to $85 assessed for each payment location

Slide 65:

Key Risks

Recognize the key operational risks and best practices for mitigation

-

Insufficient products in market

- <5% of cards

- <20% of smartphones

- Lack of passenger adoption

- Data breaches

Image provided under license from Thinkstock®

Slide 66:

Key Risks

Recognize the key operational risks

-

Fraud

- "First tap"

- Counterfeits and lost/stolen

- "Friendly fraud"

-

High Cost of Operations

- Merchant Fees

- Compliance

- Chargebacks

Slide 67:

Best Practices

Best practices for mitigation

-

Transaction Aggregation

- MasterCard: Yes, following special rules

- Visa: Yes, but no special protections

- American Express: No, since no fixed fees or protections

- Discover: No, same as American Express

-

Negative List

- Frequent updates

- Third party (issuer or network) access

Slide 68:

Best Practices

Best practices for mitigation

-

Compliance

- Assign dedicated team

- Monitor EMVCO (entity that maintains the EMV standard) and card network bulletins

- Use experts

- Tokenize bankcard data

-

Fare Policy

- Define objectives first

- Select method and options that best meets those objectives

Slide 69:

Best Practices

Best practices for mitigation

-

Merchant Fees

- Do the math - confirm fees are affordable/reasonable

- Consider aggregation as a mitigation

-

Passenger Inclusion

- Define solution for unbanked passengers

- Minimize reliance on bank issuance of contactless cards

Slide 70:

Recognize and Quantify the Benefits

-

Cost shifting/sharing

- Cardholder acquisition

- Card / account lifecycle management

-

Reduced usage of fare product sales network

- Ticket vending machines

- Transit and retail stores

- Website

- Mobile app

- Reduced reliance on agency-issued fare media

Slide 71:

Recognize and Quantify the Benefits

-

Passenger Convenience

- Familiar payment product

- No need-to-know fare

- No need to carry exact change

- No need for advanced purchase of fare product

- Ride history provided via issuer statements

Slide 72:

Slide 73:

Question

Which of the following is NOT a key risk associated with the implementation of Open Payment Acceptance with an EFPS?

Answer Choices

- Obsolete technology

- Operational costs: Standard compliance and merchant fees

- Bankcard data breach

- Issuer participation

Slide 74:

Review of Answers

a) Obsolete technology

a) Obsolete technology

Correct! Although the potential for technology to be or become obsolete within the expected life of an EFPS is always a concern, this is not a risk specific to open payments acceptance.

b) Operational costs: Standards compliance and merchant fees

b) Operational costs: Standards compliance and merchant fees

Incorrect. The regulations, standard, specifications and fees applicable to open payments acceptance is constantly changing, making the cost associated with these elements a key risk for the agency.

c) Bankcard data breach

c) Bankcard data breach

Incorrect. The acceptance of open payments may make the agency a target for theft of the bankcard data.

d) Issuer participation

d) Issuer participation

Incorrect. Open payments acceptance is dependent on widespread issuance and promotion of contactless bankcards.

Slide 75:

Slide 76:

Case Study - Utah Transit Authority

Electronic Fare Program

- Method: PAYG only

-

Highlights

- Program originally launched for visitors during skiing season

- Agency has implemented programs that promote the use of mobile wallets for fare payment

- Open Payments <1% of ridership after 6+ years

-

Key consideration

- Agency-issued closed loop card is the primary media

Image and logo used by permission from UTA

Slide 77:

Case Study - Transport for London

Contactless EMV

- Method: PAYG + Fare Capping

-

Highlights

- Agency developed and operates contactless platform

- Open Payments added as layer on Oyster system

- Growing use of contactless bankcards in retail stores

- Over 300M fares paid in first 48 months

- Cards and mobile wallets used

-

Key consideration

- Interchange restricted at 0.3% by EU regulations

Image provided under license from Thinkstock®

Slide 78:

Case Study - Chicago Transit Authority

Ventra Card HH

- Method: PAYG + Account-based

-

Highlights

- All media adheres to card network specifications

- Financial and technical risks borne by integrator

- System operations performed by integrator

- Prepaid debit card is the primary media

- Open Payments <2% of ridership after 3 years

-

Key consideration

- Lack of contactless cards and mobile wallet users

Image provided under license from Thinkstock®

Slide 79:

Module Summary

What We Have Learned

- Open Payments acceptance is defined by various international standards, specifications, and federal regulations.

- There are three primary options for implementing Open Payments acceptance.

- There are distinct costs, risks, and benefits associated with Open Payments acceptance.

Slide 80:

Thank you for completing this module. Feedback

Please use the Feedback link below to provide us with your thoughts and comments about the value of the training.

Thank you!