ITS ePrimer

Module 6: Freight and Commercial Vehicle ITS

Authored by Kenneth F. Troup, Transportation Consultant, Bolton, MA, USA.

Table of Contents

1. Purpose

The purpose of this module is to illustrate and explain major intelligent transportation systems (ITS) applications related to commercial freight truck operations, including highway and intermodal interfaces of air, ocean, or rail intermodal freight. This module also shows how these technology applications deliver operating efficiencies, customer service quality improvements, and better safety. Readers should gain an understanding of what has been tried and proven and, in many cases, what the outcomes of those trials, pilots, and deployments have been. This module should give both students and practitioners a better understanding of how current and emerging ITS technologies have been and can be used to improve freight transportation.

Return to top ↑

2. Objectives

This module explores the inter-relationships between the private and public sectors in freight transportation. The five objectives are presented to accomplish the following:

- Provide an overview of supply chain and motor carrier freight operations

- Describe public, private, and public-private examples of ITS and next generation technology freight applications

- Describe the types of freight ITS benefits delivered to different stakeholders including urban delivery and parking issues and technologies

- Describe recent freight automation advancements, future growth, and challenges

- Identify resources for increased understanding of ITS freight applications

Return to top ↑

3. Introduction

ITS applications for intermodal freight and commercial vehicle operations sit at the intersection of commercial interests, economic productivity, public safety, and security. They cover goods movement by all surface modes, including their interfaces with air- and water-based modes. This module highlights public and private sector ITS applications used in commercial motor vehicles and shippers, consignees, and government entities with which they work.

Efficient transportation of domestic and international freight (shipments of raw materials and intermediate and finished goods) is vital to the U.S. and world economies. The global pandemic in 2020-21 emphasized the importance of efficient supply chain management. ITS is critically important for order processing, delivery scheduling, and freight asset management so that goods can be in the hands of consumers when needed. E-commerce, which had been spearheaded by leading online retailers with their free and same day shipping, increased substantially during the pandemic when many retailers were closed, or consumers found it easier and safer to order online. This module provides an overview of the technologies that support logistics, supply chains, and other freight operations business models. The emphasis here is on the use of ITS technologies in commercial freight transportation on roadways from shippers to final destinations. Readers may look to Module 151 for insights into ITS applications in ocean port and terminal operations, including Port Community Systems which provide trucks with information regarding chassis and empty container availability.

ITS and emerging technologies help the freight transportation system operate more intelligently to improve the efficiency and reliability of cargo delivery. Equally important, they do so in ways that improve safety, whether related to hazardous materials transport, heavy truck maintenance, or load-limit compliance. Safety improvements affect not only freight truck operators, other drivers, and the public with whom the freight vehicles interact in the transportation system, but also property (including cargo being carried and the structures and equipment along transportation corridors). Efficiency, reliability, return on investment to freight transportation companies, and opportunities to enhance safety for operators and cargo are driving forces behind the adoption of new technologies in the supply chain.

A number of Federal agencies have interests in freight transportation. United States Department Transportation (USDOT) agencies that interact with the freight sector include the Federal Highway Administration (FHWA), the Federal Motor Carrier Safety Administration (FMCSA), the National Highway Traffic Safety Administration (NHTSA) the Maritime Administration (MARAD), the Pipeline and Hazardous Materials Safety Administration (PHMSA), and the Federal Railroad Administration (FRA). The Department of Homeland Security (DHS) and its Transportation Security Administration (TSA) and Customs and Border Protection (CBP) play important roles in freight security and international trade.

While all of the above agencies have an interest in freight information technologies, FHWA, FMCSA, and ITS Joint Program Office (JPO) have worked collaboratively with private industry to identify technologies that meet common goals and then have supported ITS field tests and evaluations. FHWA has an Office of Freight Management and Operations and FMCSA has an Office of Analysis, Research, and Technology; with ITS JPO they sponsor or administer freight technology research and demonstrations that are discussed in more detail in this module.

Introduction to the Research and Technology Sections. Topical sections drill down from supply chain management through the technologies used to manage it and the motor carriers that carry and deliver much of the freight. As an aid to the reader, the following provides a brief synopsis of each of the detailed sections of the module. Each contains a link to the text of the appropriate section. This allows readers to quickly move to areas of interest within the module.

Supply Chain Management - the use of ITS technologies in the supply chain including e-commerce, first mile/last mile, freight data, and freight performance monitoring.

Freight Technology - technologies used in freight management including in-transit visibility, freight documentation, electronic logging devices, and carrier management.

Motor Carrier Technologies - technologies used by motor carriers for managing their operations, improving efficiency and safety through truck automation, advanced safety systems, route optimization systems, and truck parking.

Industry/Government Interactions - these interactions include hours of service and inspection requirements, state freight plans, truck parking, as well as cooperative industry/government automation programs such as the FMCSA-sponsored Tech-Celerate Now.

USDOT Freight ITS Program Support - an overview of USDOT efforts including freight information and data sharing and automation pilot deployments with Federal grant funding.

Benefits of Freight ITS - general discussion of benefits to industry, government, and society with specific examples of ITS benefits.

Future Freight ITS - an overview of technologies being considered or emerging, but not yet in wide use in industry.

Return to top ↑

4. Supply Chain Management

This section provides an overview of supply chain operations including shipper needs and first mile - last mile, and the role of commercial vehicles.

4.1 Freight roles and relationships.

The essential players in freight transportation are the shipper, the carrier, and the receiver/consignee. Shippers tend to be manufacturers, wholesalers, or retailers. They originate freight shipments that vary in value, in number of shipments, or in size of shipments. Timeliness, accuracy, and completeness of shipment delivery are usually crucial to the success of their businesses, even more so with increases in e-commerce. Shippers buy carriers’ services. Carriers perform transportation operations and sell transportation services. Carriers (such as truck fleets) may be large firms or individual owner/operators that provide for-hire services. Private fleets are part of larger businesses that ship or receive cargo.

To provide better supply chain service and to find business niches, some supply chain functions between the shipper and the consignee have been integrated by firms known as third party logistics companies or 3PLs. This may involve warehousing, fulfillment centers, or arranging for transportation carriers. This outsourcing of logistics services helps the supply chain and 3PLs also implement ITS technologies to help them provide their services. More information about 3PLs is available in magazines such as Inbound Logistics and DC Velocity.

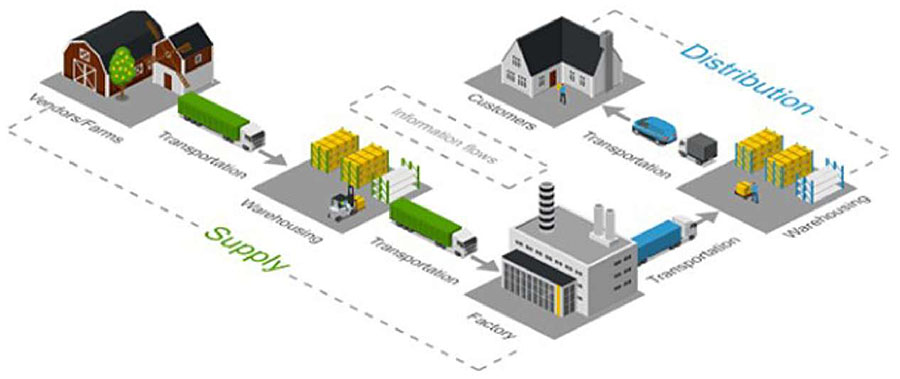

Consignees receive shipped items. As with shippers, consignees may be manufacturers, wholesalers, or retailers; shippers and consignees may even be parts of the same firm. Consignees can be the ultimate consumers of the goods being shipped and, particularly with the growth of e-commerce, a major interest area has developed with last mile delivery issues and strategies. These last mile technologies have different constraints and applications because the last mile is usually in congested urban or outlying metropolitan areas. Figure 1 shows a pictorial representation of a supply chain. Note that the trucks play roles between two players.

Figure 1. Supply Chain with Stakeholder. Source: Icograms.com

Shippers, carriers, and consignees are critically interested in the quality (i.e., accuracy, timeliness, and completeness) and accessibility of information about shipments and transportation operations and how they use technology to process, share, and use the information. With continued improvements and advances in ITS and online applications, the information associated with freight movement is as important as the cargo. The information is valuable in at least two contexts: first, in terms of supply chain management (with respect to physical distribution, customer satisfaction, and cash flows); and second, the broader use of ITS and traffic information, because of the connection between the movements of goods and the efficiency and broader impacts of congestion on transportation networks.

A key source of information about current and future supply chain trends is the 32nd Annual State of Logistics Report produced currently by Kearney for the Council of Supply Chain Management Professionals (CSCMP). (https://cscmp.org/CSCMP/Research/Reports_and_Surveys/State_of_Logistics_Report/CSCMP/Educate/State_of_Logistics_Report.aspx?hkey=cc8f19e1-1e5f-4144-8b32-15a83d821e4a2. Membership in CSCMP is needed to obtain the full report for free.)

4.2 Growth of e-commerce.

With the increases in online retail customer ordering and e-commerce, omni channels and supply chains have become more complex, demanding even greater speed and service reliability. The trend has been for smaller, more frequent shipments and a shift toward parcel shipping away from traditional, less-than-truckload (LTL) or larger shipments (although LTL continues to grow, it is at a slower rate), a shift that accelerated during the pandemic. In addition, timeliness of shipments has become more important, building in part on the popularity of free shipping and then even same day shipping by e-commerce firms. Shipper and carrier transportation management systems (TMS) evolved to support parcel shipping, a departure from earlier truckload (TL), and LTL focus.

Globalization of sourcing and assembly required more automated capabilities to handle more complex international shipments. Another important trend in supply chain management has been the significant complexity in supply chains for e-commerce leading to more and smaller shipments, many via the large international parcel services, with an increased emphasis on timeliness of delivery. That became particularly important during the pandemic when consumers were forced to stay home and ordered substantially more items to keep their households functioning. Additional background on e-commerce for sellers of goods for shipping by parcel carriers can be found at https://sell.amazon.in/seller-blog/advantages-of-ecommerce3.

It is worth noting that the U.S. Postal Service (USPS) plays a significant role in e-commerce, particularly for small parcels under 2 pounds and for deliveries to rural areas where commercial e-commerce deliveries have higher rates. USPS also plays a role in final delivery in conjunction with some commercial e-commerce carriers. More information about the commercial-USPS interactions in e-commerce can be found at https://ecommerce-platforms.com/articles/ups-vs-usps-which-is-better-for-your-ecommerce-store.4

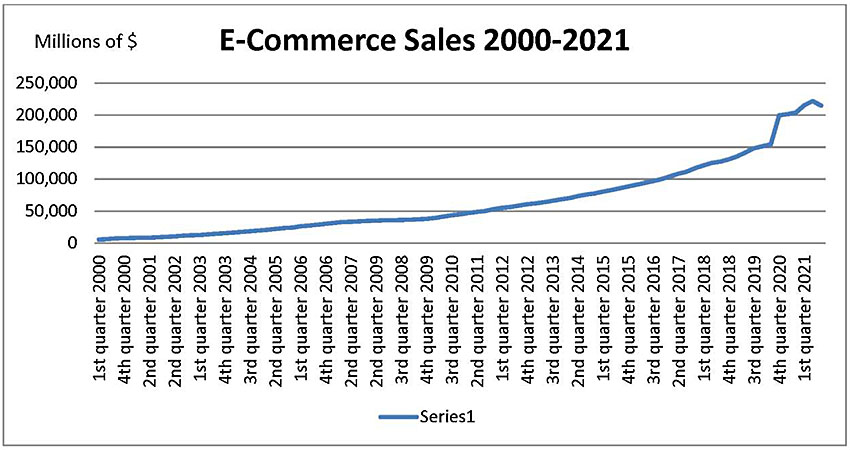

According to the 2021 E-Commerce Consumer Survey5 released by 3PL Kenco Logistics in July 2021, e-commerce purchases, some of which were picked up in-store, in 2020 grew by 33 percent to $792 billion, representing 14 percent of all retail sales. Figure 2 shows e-commerce growth trends since 2000.

Figure 2. E-Commerce Retail Sales. Source: Kenneth Troup with Census Data.

The aforementioned consumer survey found that although free and next day shipping became very popular, 49 percent in the survey said they would prefer 2-day service if the reliability of the promised delivery could be improved. 84 percent say they will continue at e-commerce levels post-pandemic.

To gain a wider perspective on the shippers involved in e-commerce, readers are referred to a white paper by an e-commerce ITS provider at https://vargosolutions.com/news-resources/white-papers/emerging-trends-in-e-commerce-fulfillment/6. In its paper, Vargo notes that more and smaller e-commerce fulfillment centers were needed to meet consumer demand and delivery requirements and that some fulfillment centers had to take on more of the work previously handled by parcel carriers including sorting packages for ZIP code zones for regional carriers to transport packages to local markets. This involved implementing technology that can sort packages by size, weight, and ZIP code zone. Further, some shipper TMSs have the capability to account for the cost and open capacity of the parcel carriers when making the carrier decision.

4.3 First and last mile pick-up and delivery.

As noted earlier, there has been an increased demand for last mile delivery because of e-commerce, and that was exacerbated by the pandemic. The last mile issue has become larger than just urban-focused as more and more parcels are delivered directly to consumers, sometimes as a regular part of USPS mail delivery and through metropolitan and suburban areas. Delivery trucks are impacted by urban traffic congestion that threatens the timeliness of delivery and also by the need for parcel delivery in high rise condominiums or apartment buildings, some of which may be located on narrow city streets that already lack sufficient parking. Further, rural deliveries have increased as well, often at higher rates for the parcel carriers. Some of the commercial carriers work with USPS which completes some rural deliveries.

The University of Washington is an example of university research underway in last mile delivery. They looked at carrier locker systems7 that may be accessed by any retailer, carrier, and purchaser. This is in contrast to another solution that has been implemented in some cities by some e-commerce companies such as Amazon or Walmart to have their own lockers. Whether company-specific or common, such lockers concentrate delivery and significantly decrease the time it takes for a carrier to service a high-rise building, as much as 73 percent in the Seattle study. Some e-commerce carriers might also have store front delivery points where consumers can pick up their parcels. These sometimes include lockers set up in larger establishments. In a similar effort, the University of Washington conducted a pilot in downtown Seattle for a Microhub or central drop-off/pick up location for parcel delivery. See https://depts.washington.edu/sctlctr/research8 for more information.

Source: Kenneth Troup

There has been considerable research into ways to improve last mile delivery and to address truck parking. Some of these efforts have included the potential use of cellphone apps and ITS technologies to manage the curbside, including reservations that help to reduce traffic congestion. Some of this is covered in more detail in later sections of the module. More is described at https://depts.washington.edu/sctlctr/news-events/announcements/new-parking-app9

4.4 Importance of freight data to the supply chain.

Information about what is moving is often as important as the freight itself. Historically, freight transportation paperwork was notoriously late, incomplete, and inaccurate; an old industry saying was, “The cargo moves despite the paperwork, not because of it.” In the 1960s and ’70s, the railroad and trucking industries pioneered efforts to automate freight information flow. They implemented systems within their companies to help manage the flow of freight data. They also worked with their customers toward automating business transactions including ordering of transportation, billing information, visibility of shipments, and automated payment of bills. The railroads introduced

Car Location Messages so that railroad interchange partners, as well as shippers and receivers, could know the status and whereabouts of shipments. Industry leaders promoted freight data standards such as electronic data interchange (EDI) for domestic and international shipments. For more discussion of the current relationship between EDI standards for data transfer and computer or cloud based application programming interfaces, see this blog https://www.cleo.com/blog/edi-vs-api10.

With the widespread use of the Internet, carriers began implementing websites that their customers could use to book a carrier and to check on the status of shipments. Parcel delivery firms such as United Parcel Service (UPS) and Federal Express (FedEx) became legendary for their automated freight data and their ability to provide an individual customer with precise information about the status of a shipment.

Shippers, consignees, and logistics service providers have made important and substantial improvements in supply chain data quality and accessibility. Source data automation often meant that transactions—such as a terminal gate entry—could generate status messages. Shipment visibility improved with transaction and status data available on carrier websites or, increasingly, Internet data links. Delays or unexpected changes in shipment plans could trigger alerts for supply chain partners. This became more important than ever during the pandemic which provided countless operational and coordination challenges to suppliers as well as carriers. More sophisticated data analytics have enabled firms and their partners to better plan shipment routing and scheduling and to manage uncertainty. Company websites and cell phone apps have become commonplace and indispensable. There is more discussion of freight data and its use in government and industry in section 7.5.

Return to top ↑

5. Freight Technology

This section provides a high-level overview of applications of current and next generation technology in each part of freight management. Some of the technologies were alluded to in the discussion in the previous section. The current section discusses ITS technologies used in freight including in transit visibility, freight documentation, electronic logging devices, and carrier management. The overview here is focused primarily on what the freight industry shippers and carriers need. The 32nd Annual State of Logistics Report cited in the previous section noted that the pandemic accelerated interest in technology that improves visibility and automation of freight movements. The Texas Department of Transportation (TxDOT) prepared a series of reports under the banner of “Texas Freight Network Technology and Operations Plan” which addressed Texas’ state freight plan requirement from the Federal Fixing America’s Surface Transportation (FAST) Act. One report in particular titled “State of the Practice Assessment Report” includes freight ITS and related efforts in other states, regions, and cities in the United States and in some cases Europe. Readers are encouraged to look at this and the other TxDOT reports for an excellent snapshot of freight technology (https://ftp.txdot.gov/pub/txdot/tpp/freight-planning/fntop/state-of-the-practice.pdf)11. Later sections of this module discuss some of the government interests and involvement in freight technology, which are also very well-covered in the TxDOT series. Additionally, ePrimer Module 151 has a very useful and detailed table of technologies used in ports, including the motor carriers who service them. Rather than repeat that table here, the section will highlight some of the motor carriers use of technologies noted in that table.

5.1 Supply chain planning.

Many shippers use ITS technologies in the form of TMSs for trip planning and routing, carrier selection, freight documentation, and maintaining contact with their carriers who frequently track shipments. There are many vendors of supply chain management technologies that can help with distribution, scheduling, and TMSs. Communicating with carriers, suppliers, and customers is key, and over time, most of the planning functions in larger supply chain partners have gone online to eliminate paperwork and improve supply chain efficiency and security.

5.2 In transit visibility.

ITS, when used in an integrated fashion and connected, provides shipper-carrier information about the freight. Global Positioning System (GPS)-based systems and the use of RFID and sensors on vehicles (tractors and trailers) help provide the foundation for maintaining in-transit visibility. GPS is a valuable tool for many ITS and other transportation-related applications.

GPS is a tool that uses a network of special-purpose satellites that provide signals used by GPS receivers or transponders to calculate their geographic location. GPS receivers use the signals from multiple satellites to calculate their latitude and longitude to precise degrees. Other systems use the location data and may include it in one or two-way communication systems. Most fleet management systems depend heavily on GPS inputs, but GPS itself is not a communication system. The visibility data is shared with customers and is an important shipper-carrier collaboration point. Companies such as Tive and project44 provide online, in-transit visibility platforms. A recent survey12 by Tive and FreightWaves shows that only 37 percent of responding shippers use visibility solutions.

5.3 Electronic Logging Devices (ELD).

ELDs are used to record truck driving time and were mandated in December 2017 by FMCSA in response to Congress’s Moving Ahead for Progress in the 21st Century (MAP-21) requirements. ELDs capture engine data, location, speed, and miles driven. Trucks made before the year 2000 are exempt. The reporting can be done with a cell phone. FMCSA requires ELD for Record of Duty Status and Hours of Service. There is more discussion of ELDs in Section 7. While some carriers and drivers have found ELDs to be intrusive, others have found them helpful in accurately capturing data that used to require manually-prepared logs and in normalizing driver work schedules and hours. (https://www.fleetowner.com/technology/article/21701619/7-truck-technologies-you-need-and-why.13)

5.4 Freight documentation.

Freight documentation involves paperless technology transfer and recordkeeping by all parties in the supply chain, where the goal is to enter data once and have it transmitted from supply chain partner to supply chain partner. EDI helped eliminate paper and, as discussed later related to customs documents, played an important role in standardizing shipping documents and invoices to facilitate online transfers. Web-based status information, bills of lading, shipment lists, and invoices are important documentation that uses freight technology.

5.5 Carrier management.

Career management involves fleet management technologies, truck communications, and data. Shippers need to communicate with their carriers about the timing and size of loads so that they can coordinate loading times and delivery requirements.

Expertise and time for implementing new solutions is likely to remain a primary challenge for adopters of new technologies, but it may wane once the industry has ascended the learning curve. If there’s any silver lining to the events of the past year and a half, it’s that the industry has made strides adapting to new processes, rapidly streamlining supply chain management in what many believe to be years ahead of projected rates of adoption.

Conclusion from a white paper titled “What Does It Mean To Optimize A Supply Chain?”

By Freight Waves and Locus September 2021.

Carriers use similar technologies to manage their individual trucks, perform load matching in efforts to reduce empty mileage and allow more efficient backhauls, and provide updated location and delivery status information back to the shipper.

Return to top ↑

6. Motor Carrier Technologies

This section provides an overview of technologies used by motor carriers for managing their operations. The motor carrier industry publication Transport Topics has continuing coverage of motor carrier technologies, both current and emerging. Their website has a technology section worth reviewing (https://www.ttnews.com/technology14). There is also useful technology discussion in a 2017 article in FleetOwner magazine https://www.fleetowner.com/technology/article/21701619/7-truck-technologies-you-need-and-why13. As with Transport Topics, FleetOwner has a technology section on its website that can keep a reader up to date.

6.1 Fleet scheduling and navigation.

Carriers use ITS and freight management data in managing transportation assets, whether they are a fleet of tractors, intermodal containers, truck trailers, or labor management. The technology and online communications combined with GPS help in maintaining truck location information and combined with other data can be used for not only routing an individual truck on a specific customer order, but identifying and planning the next and later loads to help plan the driver’s day. Carrier scheduling often incorporates transportation navigation services, congestion alerts, and avoidance technologies and data. An important feature of these navigation systems is that they include freight-specific information such as bridge height and route restrictions applicable to trucks, designated truck route, and hazardous materials route restrictions, all things that are not in the passenger vehicle or cell phone-based navigation systems the non-trucking community uses. The services or products include TomTom, PC-Miler, INRIX AI, Trimble MAPS, and PTV. TxDOT’s State of the Practice11 report has useful summaries of these navigation products on p 79-83.

Fleet and terminal manager software systems may be programmed to incorporate feeds from regional or local congestion monitoring portals. At the simple end, dispatchers pass along bottleneck information to drivers; more sophisticated solutions may include dynamic adjustment of trip schedules and strategic shifts in operating policy, such as moving to more nighttime operations. Generally speaking, most drivers no longer need to phone in about delivery or to inquire about the next load; dispatchers or the systems automatically text the relevant information to the drivers. The fleet management software simplifies the dispatcher’s job and keeps the driver better informed of his or her pick-ups and deliveries. The technology is useful in accounting for hours of service, time on duty, mandatory rest stops, and similar Federal regulations on drivers. Some fleet management software has mobile apps for iOS and Android devices for drivers to track their own performance and obtain other pertinent information through a smartphone. Fleet management systems can help in situations where loads travel between terminals and change drivers. Readers who want to know more about how technology has helped with dispatch and vehicle scheduling may wish to read several articles noted below:

6.2 Sensors.

The freight transportation industries have long used cargo and freight condition sensors. Perhaps best known, temperature sensors and recorders improve the quality and accountability for perishable shipments. Pressure and toxic substance sensors enhance the safety of hazardous materials (hazmat) shipments. Accelerometers tied with GPS help ensure that highway impacts and shocks stay within contracted limits, help assign responsibility for problems, and help map problem patterns.

Some truck fleet operators use sensor data for vehicle operating parameters, such as engine revolutions per minute, highway speed, tire pressure, and brake wear. The information helps managers anticipate maintenance problems and reinforce safe and efficient driver behavior.

6.3 Communications.

Vendors developed on-board computers integrated with satellite-based location determination systems. Satellite-based, wide-area telecommunications complemented the location determination capabilities. As cellular phone capabilities and coverage matured, many fleet-oriented ITS tools migrated to dual mode or strictly cellular communications. The computers and communications tools monitored and reported data from on-board sensors for cargo condition, mechanical performance, cargo security, and driver emergencies. All the distributed capabilities were pulled together in centralized fleet management systems, discussed earlier in section 5.5.

A truck with wide-area and long-range capability, including smartphones, can communicate with its base almost any time and from anywhere. A truck with short-range capability such as citizens’ band (CB) radios, can only communicate when within the (short) range of a transmitter/receiver (3 to 20 miles depending on terrain). Because cell phones and mobile apps are so widely available today, truck drivers rarely use their CB radios. That is a significant change from a few short years ago when CBs were a necessity since drivers received road and traffic conditions and law enforcement location information from other drivers. Cell phones can now be used to do the same thing and stay more closely in touch with families as well as dispatchers. There are now many smartphone apps18 (e.g., Waze or Trucker Path) available to truckers to communicate as they did with CB radios. There are apps that can do fleet management types of information exchange, apps to identify truck stop locations or provide alerts for upcoming exits, or even access free audio books. Most drivers have smartphones and more than half use them to keep track of daily business. For additional information about CB radios, readers may be interested in the article at https://www.highlandwireless.com/do-truck-drivers-still-use-cb-radios-to-communicate/19

6.4 Advanced Driver Assist Systems (ADAS) technologies.

Several features that are now called ADAS are already available on many new trucks and are increasingly used within the industry. These include adaptive cruise control, lane keeping assist, and automated emergency braking. These technologies and efforts to increase the application and use of ADAS are discussed in more detail in Section 7.6.

6.5 Truck parking facilitation.

Truck parking was the number one problem among truckers in American Transportation Research Institute’s (ATRI’s) Critical Issues in the Trucking Industry -2020 survey20, and number three overall when all motor carrier respondents were considered; the highest rank in the report’s history. Truck parking demand is tied to a set of factors associated with highway safety, hours of service rest requirements for truck operators, and truck operations in the context of long supply chains. Truck parking shortages exist in most areas but are more acute along major freight corridors and in regions with large amounts of freight generators. The pandemic further exacerbated the parking shortage in 2020, as a number of states closed public rest areas, removing capacity from an already constrained system. Concerns over parking have grown with the use of ELDs to monitor the newly enacted hours of service rules. While technology does not increase the parking capacity, truck parking information systems have been implemented in a number of states to aid drivers in locating available parking, which maximizes utilization of available capacity.

Truck Parking Information Management Systems use ITS to collect and disseminate information on the availability of truck parking. These systems collect data on parking availability with equipment installed in rest areas to detect vehicles occupying parking spaces or counting vehicles as they enter or leave a rest area. This is used to identify available parking and disseminate the information to drivers through State 511 websites, dynamic messaging signs, and smartphone applications. Florida DOT has conducted truck parking availability studies and documents about a Truck Parking Availability System (http://www.floridatruckinginfo.com/Docspubs.htm21). Texas Transportation Institute at Texas A&M (TTI) has done similar work in parking detection technologies for Texas DOT (https://tti.tamu.edu/researcher/making-space-for-big-rigs-tti-helps-txdot-evaluate-technologies-to-facilitate-truck- parking/22).

There are private systems operated by truck stop operators, private firms, and public agencies. Data for the parking information systems may be sourced from the truck stops, crowdsourced, or sourced from paid parking providers. Individual truckers, or their company dispatchers, can use the available information to plan their routes and reserve spaces in advance. There continues to be public and private introduction of parking apps based on local and regional data about the location of truck parking. There is more discussion of industry-government cooperation in truck parking in section 7.4 and on future research in section 10.4. A three-part article in FleetOwner provides additional information about what technology providers are doing to help address the parking issue:

- Part 123 Tech Providers Aim to Ease Truck Parking Concerns with Real-time Information

- Part 224 Truck Stops Step Up To Combat Parking Crisis

- Part 325 Using Reservations Ensuring Safety Part of Solving Truck Parking Crisis

6.6 Compliance with federal and state safety and customs regulations.

Trucks have on-board sensors and devices to collect operating information that can be used for reporting compliance with hours of service, truck inspections, and monitoring truck safety. They also have the technology for communicating with weigh stations, including the ability to bypass physical inspection locations. Fleet scheduling and dispatching systems for the motor carrier compile the driver operations data which is then used for reporting to state and Federal transportation departments. Chief among these on board devices and a key input to the carrier’s system is the ELD mandated in December 2017. This was briefly discussed in section 5.3 and is discussed in more detail in section 7.3. That section also includes a discussion of the detailed online requirements for carriers to provide import and export information to CBP.

Source: USDOT.

Return to top ↑

7. Industry/Government Interactions

This section discusses the various regulatory functions that governments have related to private freight movement, how the government works with the industry, and how technologies and government contributions play a part in those interactions.

Public regulatory interests in motor carriers include the following:

- Safety assurance (safety records, screening, and inspections)

- Special permitting (oversize/overweight (OS/OW))

- Credentials and tax administration (hazmat, licensing, and more)

- Driver authentication (commercial driver’s license (CDL) and biometrics).

Industry and government interests related to the regulatory functions are different and yet compatible as shown in Table 1:

Table 1. Public and Motor Carrier Interests in Motor Carrier Regulation

| Public Business Interests |

Motor Carrier Business Interests |

| Effective use of scarce inspection resources |

Minimizing burdens of regulatory compliance |

| Efficient toll and credential processing |

Reducing potential bottlenecks and lost productive time at inspection stations |

| Quick, reliable exchange of information with other jurisdictions and carriers |

Optimizing safety performance, insurance costs, and customer satisfaction |

Source: Module 6, 2014, Wolfe and Troup

7.1 Truck size and weight.

States must ensure that commercial motor vehicles comply with Federal size and weight standards. FHWA is responsible for certifying state compliance with Federal standards. A number of states have implemented electronic systems that capture information and generate the required permits. According to a USDOT report26 from 2018, at that time 30 states had implemented Automated Permit Systems. Generally speaking, these systems performed the following automated functions:

- Accept, analyze, process, and issue permits

- Issue single trip permits for oversize/overweight (OS/OW) vehicles

- Issue OS/OW permits for width, height, length, and weight

- Operate 24-hours per day, seven days per week

- Operate on behalf of the state, without human involvement

7.2 Truck inspections and weigh stations.

A virtual weigh station is a roadside enforcement facility that does not require continuous staffing and is monitored from another location. Virtual weigh stations27 are established for a variety of purposes depending on the priorities and needs of each jurisdiction. Typical purposes include safety enforcement, data collection, security (e.g., homeland security, theft deterrence), and size and weight enforcement. These sites may use a variety of sensor components to collect data, such as a weigh-in-motion28 installation, a camera system, and wireless communications.

Source: USDOT

7.3 Hours of service rules.

As noted earlier, FMCSA has implemented revised hours of service (HOS) rules and required the use of ELDs to electronically track and record commercial truck drivers’ hours to ensure drivers are operating these vehicles within the requirements. The industry submitted numerous comments to FMCSA as the changes to HOS evolved. The ELDs make reporting much easier and some larger trucking firms, in particular, believe the ELDs give them a competitive advantage13.

7.4 Truck parking management.

State DOTs, as well as USDOT, have done studies and worked together in efforts aimed at improving the truck parking problem discussed earlier in section 6.5. FHWA has played a key role in trying to solve the truck parking problem. Their website has useful information about the extent of the problem and some of the solutions being pursued (https://ops.fhwa.dot.gov/Freight/iucture/nfrastrtruck parking/index.htm29). As further described on that website, FHWA helped form a National Coalition on Truck Parking that includes public and private sector organizations with an interest in advancing safe truck parking. The Coalition brings together stakeholders from the trucking industry, commercial vehicle safety officials, state DOTs, MPOs, and commercial truck stop owners and operators, most recently at a virtual meeting30 in December 2020. The American Association of State Highway Transportation Officials (AASHTO) representative noted that it hopes to perform research through TRB’s National Cooperative Highway Research Program. NCHRP 08-14031 is planned to identify national interoperability standards for truck parking information management systems. AASHTO noted that states are implementing new systems and so need national open source standards on ITS architecture, physical design, location of signage, and interoperability between systems and states. AASHTO will review a series of existing systems from Florida, the Mid-America Freight Coalition Truck Parking Information Management System (TPIMS), and others as case studies to understand future performance and integration of these systems in future technologies.

A representative from ATRI described some findings from an ATRI survey on truck parking that was subsequently published by ATRI in 2021 that indicated that 70 percent of drivers found variable message signs with real time parking information helpful, but they questioned the accuracy of real time information systems. According to ATRI, drivers are willing to use systems, but improvements have to be made to increase utilization. See more details in “Truck Parking Information Systems: Truck Driver Use and Perceptions” ATRI June 2021.32. Studies such as NCHRP 08-140 and other actions of the National Coalition may help further advance the technologies that help alleviate truck parking problems. Future research needs in truck parking are described in section 10.4.

7.5 Freight performance monitoring.

Supply chains are generally private, but trucks operate on public infrastructures with other traffic. State and local governments and law enforcement monitor overall traffic movement. Freight planning at the state or regional level is important so that transportation carriers can do their jobs in a safe and efficient manner. The impacts of freight movement, both positive to a local economy and negative with respect to traffic or fuel consumption or air quality, are important to states and localities and the infrastructure they operate and maintain. The governments are charged with assuring that the road transportation system for passengers and freight can operate. This involves analyzing freight movements at a higher level.

To the freight industry, reliability is of critical importance. Many industries rely on just-in-time delivery. Unreliable freight travel times can increase fuel and driver costs and delay shipments, slowing down efficiency, negatively impacting productivity. Reliable freight movement promotes economic competitiveness and economic growth. To the public sector, freight reliability performance measures help analyze overall freight efficiency on the network, so measures have been developed to track day-to-day Truck Travel Time Reliability (TTTR).

The FHWA Office of Freight Management and Operations promotes freight and sponsors research to improve the performance of the freight system. This includes freight performance monitoring and the identification of bottlenecks on the National Highway System. One of FHWA’s programs for performance monitoring is the Freight Fluidity Measurement project. Freight fluidity refers to the performance of transportation supply chains and freight networks. As reported by FHWA, the Texas A&M Transportation Institute (TTI) developed a framework for tracking and measuring a supply chain’s freight performance using travel time, travel time reliability, and cost as its performance metrics. (https://ops.fhwa.dot.gov/publications/fhwahop17029/summary16.htm31). TTI has provided freight fluidity technical assistance to FHWA, numerous states (TX, MD, CO), Transport Canada, and the U.S. Army Corps of Engineers. In 2019, TTI presented at a TRB freight data workshop an overview of its fluidity work in Texas33. In 2021, TTI developed a guidebook on freight fluidity for the Texas Department of Transportation, titled Implementing Freight Fluidity for Texas and Its Regions. Readers may wish to consult the TTI catalog (https://tti.tamu.edu/publications/catalog/) for a link to this pending report. Also related, TRB conducted a workshop on freight fluidity that is available at https://onlinepubs.trb.org/onlinepubs/circulars/ec240.pdf34

FHWA works with the Bureau of Transportation Statistics (BTS) to collect data that can be used for performance monitoring. As part of the Fixing America’s Surface Transportation (FAST) Act in Title 23 of the United States Code (23 U.S.C. 150), FHWA is required to establish performance measures that states and metropolitan planning organizations (MPOs) use in their operations and coordinate with FHWA. An example with respect to trucking industry performance is the National Performance Measure to Assess Freight Movement: Truck Travel Time Reliability. This index measures the ratio of the 95th percentile travel time to the 50th percentile travel time. Interested readers may want to visit the FHWA website State Performance Dashboard and Reports, where all the performance reports are located for all states, including the TTTR measure: https://www.fhwa.dot.gov/tpm/reporting/state/35. More about FHWA’s performance management requirements can be found at https://www.fhwa.dot.gov/tpm/rule.cfm36. FHWA, BTS, and TRB’s Freight Data Committee work closely together on freight data collection and analysis. The important use of freight data, such as the Freight Analysis Framework (FAF5), is discussed in more detail in section 8.3.

Source: USDOT

7.6 Cooperative industry/government programs.

In conjunction with the American Trucking Association, FMCSA and ITS JPO in 2020 created a joint program37 to promote ADAS in the trucking industry. The program is called Tech-Celerate Now and the joint effort involves “Accelerating the Adoption of Advanced Driver Assistance Systems (ADAS).” The program surveys trucking industry stakeholders on a regular basis to determine the level of ADAS deployment, serves as an industry resource on available ADAS technology, and provides technical information and video content to spur additional adoption (https://www.fmcsa.dot.gov/Tech-CelerateNow)38. The website notes that the four key ADAS capabilities that they believe will improve motor carrier safety are the following:

- Active Braking Systems, including automatic emergency braking, air disc brakes, and adaptive cruise control (ACC) to maintain a preset distance between the truck and the vehicle in front.

- Active Steering Systems, which include lane keep assist, lane centering, and adaptive steering control).

- Active Warning Systems, including lane departure, forward collision, and blind spot detection. These warn the driver of an impending crash through both audio alerts and pulses on the driver’s seat.

- Camera Monitoring Systems, which include in-cab facing driver training, forward facing event recording, and side rear-view for mirrors)39.

The website includes available documents about ADAS for truck drivers, as well as trucking companies.

More generally, USDOT, state departments of transportation, universities, and the motor carrier industry work together to advance freight transportation through involvement in the various freight-related TRB committees including the Urban Freight Transportation Committee, the Intermodal Transportation Committee, and the Freight Data Committee. This includes sponsored research as well as seminars, workshops, and sessions at TRB meetings. Of particular note to the subject of freight ITS are the series of Innovations in Freight Data Workshops as well as trucking-related topics at what is now called Automated Road Transportation Symposiums (the most recent, a virtual event called ARTS21). Presentations and/or reports from annual symposia and workshops are available through TRB’s website40. Many states have government-led programs that work with their local universities, the freight industry, and the Federal government on freight issues. The Texas DOT, Georgia DOT, and Washington State DOT are just three examples of active state programs with numerous public reports on freight issues that add to the available literature. Some of TxDOT’s reports were cited in other sections of this module.

7.7 Military Freight Transportation and Interactions with Industry.

The U.S Department of Defense (DOD) is the largest single customer of commercial freight transportation. Motor carriers contract with the Defense Logistics Agency or the Surface Deployment and Distribution Command or with suppliers to the military. The 1990 Gulf War increased demands for data integration and accessibility for commercial containers carrying military equipment including in-transit visibility (ITV) and total asset visibility (TAV). This led to fielding automatic identification RFID tags to feed data to ITV and TAV. DOD’s initiatives and lessons learned were catalysts that accelerated the spread of RFID applications to commercial logistics management. The programs attempted to tie together information from DOD’s distribution and transportation management systems, including commercial carrier data about events and transactions in the supply chain, updated all the way into the military theater of operations. The need for integrated distribution management only increased in the Middle East wars that followed. While there were improvements that helped DOD manage its military actions in Iraq and Afghanistan, their experience has shown how difficult it is to implement ITV in a large and complex organization. During these military operations, there were increases in needed shipments by commercial carriers either to DOD distribution centers or to military vessels at US ports, including shipment visibility data from the carriers.

7.8 Tracking Government Shipments and Hazardous Materials.

Two government agencies developed and operate systems to track sensitive government shipments. One is the DOD’s Defense Transportation Tracking System (DTTS)41, and the other is the Department of Energy’s (DOE) Transportation Tracking and Communications System (TRANSCOM)42. DTTS monitors shipments of arms, ammunition, and explosives (AA&E), and the TRANSCOM System monitors shipments of radioactive waste and other special nuclear materials. These systems do route adherence monitoring, a special application of asset tracking, and they tie in with commercial motor carriers who transport the sensitive materials. Although there is not a government hazmat tracking system, there are commercial suppliers of such tracking systems which follow USDOT hazardous materials requirements and report incidents as needed. An example can be found at http://www.reltronicstech.com/Hazardous_Material_Tracking.html.43 Site no longer available.) Some urban areas have hazmat routing restrictions for trucks and that information is an important part of truck-oriented routing and navigation software such as Axon Software’s PC-MILER or Omnitracs systems. These truck systems are important because personal auto-oriented navigation systems may not have hazmat restrictions as part of them. There are placarding requirements for hazmat that are part of the PHMSA hazardous materials regulations.

7.9 Land Border Customs Enforcement and Import Requirements.

After 9/11 in 2001, the United States government led international efforts to secure the supply chain when U.S. Customs and Border Protection (CBP) introduced three programs. The Customs-Trade Partnership Against Terrorism (C-TPAT), a voluntary program, continues to promote the adoption of security best practices among shippers, carriers, consignees, and their supply chain partners; CBP reviews corporate security plans and periodically validates (inspects) compliance. The most recent security best practices document44, while not ITS per se, uses all of the communications and computer resources of carriers to meet the best practices. To help facilitate legitimate cross-border trade security, both Canada and Mexico have companion programs to C-TPAT. Canada’s program is called Partners in Protection (PIP) and in Mexico, the program is called Authorized Economic Operator (AEO).

The Container Security Initiative (CSI) “pushed out the borders” with prescreening of U.S.-bound container cargoes at selected originating ports. CSI also initiated the use of ITS-like technologies to automate container and cargo screening with x-rays, gamma rays, and other solutions. Container screening is now conducted both in participating foreign ports and upon arrival in the United States, in part with scanners provided by the Department of Homeland Security (DHS) to the foreign customs agencies. In addition, all air cargo entering the United States is scanned. (See Module 15 for more discussion of containers at U.S. ports.)

Since 2009, CBP has had an Importer Security Filing requirement, commonly known as “10+2.” The current rule requires ocean carrier importers to provide 10 essential data elements about a container and its contents, and carriers must provide two items (the vessel stow plan and container status messages). Importers must deliver their information at least 24 hours before container loading, and carriers must deliver their information 48 hours after vessel departure for the United States.

Customs and Border Protection (CBP) operates the Automated Commercial Environment (ACE) Secure Data Portal and EDI Filing required for all imports coming across land borders by motor carriers. The Secure Data Portal is a free, web-based access point designed to connect CBP with trade partners. It uses the standard EDI documents for international trade to help clear the inbound freight. The freight data involved in these imports is a crucial part of motor carrier activities with Canada and Mexico. Managing, processing, and transmitting that freight data has become a business itself as software developers developed and sell programs that meet CBP requirements. CBP publishes a list of software developers45 for truck border crossing documentation, specifically the ACE electronic truck manifest. CBP points out that companies on the list have met CBP’s testing requirements, but that there are other suppliers and inclusion on the list does not constitute endorsement. The automated broker interface (ABI)46 at CBP allows qualified participants to electronically file required import data with CBP. ABI is available to brokers, importers, carriers, port authorities, and independent service centers, and most entries filed with CBP are filed through ABI. As with the software developers noted above, CBP publishes a list of vendors who have been certified by CBP. CBP is currently working to transition cargo processing to the ACE. Progress can be followed on the CBP website at https://www.cbp.gov/trade/automated47.

Return to top ↑

8. USDOT Freight ITS Program Support

This section includes a brief discussion of freight initiatives in USDOT with links or references to more detailed information. The section starts with a discussion of completed ITS projects and then described current ITS research and grant efforts.

8.1 Past Commercial Vehicle Operations (CVO) ITS Programs.

Through the research program administered by USDOT’s ITS JPO, there have been notable connected vehicle and ITS projects that have laid the groundwork for current ITS technologies and provided technology advances for the next generation. From past programs listed in the ITS JPO archive, https://www.its.dot.gov/research archive.htm48, the following freight efforts were included:

- Connected Vehicle Technology

- Truck V2V Research

- Truck V2I Research/Smart Roadside

- Dynamic Mobility Applications

- Commercial Vehicle Information Systems and Networks (CVISN) - Core and Advanced Deployment Program

- Electronic Freight Management

8.1.1 Connected Vehicle Technology. One of the three connected vehicle pilots sponsored by the USDOT ITS-JPO and awarded during 2015, involved truck movements on the interstate highway in Wyoming and a testbed for further V2I and V2V advances. After completing a concept of operations, a 402 mile section of I-80 was instrumented and testing showed that increased coverage of road condition reports, enhanced in-vehicle advisories such as parking, detours, and emergency service notifications, and improved V2V communications of such things as road conditions and posted speeds would be helpful to motor carrier operators and generally improve safety along the corridor, especially during harsh winter months. Numerous reports on the ITSJPO website49 have documented the results and lessons learned. The other two connected vehicle pilots in Tampa and New York City were focused on urban freeway and city street connected operations for all modes.

8.1.2 Truck V2V Research. In the last 5-10 years, USDOT has had an active Vehicle-to-Vehicle (V2V) Truck Safety Program that aims to accelerate the development and commercialization of commercial vehicle technologies based on V2V. ITS JPO’s Truck V2V research focused on refining the broad V2V advancements for heavy vehicles, including safety applications and onboard systems for heavy vehicles (see Module 1350, Connected Vehicles, for details about V2V technology). The project began in 2011 and resulted in testing three trucks. The research has highlighted that the previously developed light vehicle technologies and applications can be leveraged for the truck platform. However, there were some truck-specific needs that continued to be studied. This involved refining the V2V basic safety message (BSM) to more accurately define a trailer and be able to transmit this information to nearby vehicles.

In 2014, USDOT held a series of driver acceptance clinics with heavy-truck drivers to gauge their acceptance of collision warning applications using V2V technology. A total of 112 subjects drove trucks towing 53-foot semitrailers through scripted maneuvers on closed courses and rated their impressions in surveys. The results indicated high acceptance in each of five criteria used to define driver acceptance: usability, perceived safety benefits, understandability, desirability, and security and privacy. The Volpe Center further analyzed the data in 2016, as documented in a report Driver Acceptance of Collision Warning Applications Based on Heavy-Truck V2V Technology, DOT HS 812 336, October 2016.

The majority of subjects viewed the system as no more distracting to use than a car radio, nonetheless, they thought it would result in drivers paying somewhat less attention to the road. There was no effect of age on acceptance. Warnings had both auditory and visual components and the combination of the two was preferred to either the visual or auditory components alone, although, for the visual component, some subjects felt uneasy with having to take their eyes off the road to see the screen. The technologies discussed with the drivers included intersection collision warnings (intersection movement assist, or IMA), forward collision warnings (FCW), blind spot/lane change warnings (BSW/LCW), and emergency electronic brake light (EEBL) warnings of hard braking by one or more vehicles ahead. See also https://www.nhtsa.gov/sites/nhtsa.gov/files/812224-heavytruckv2vreport.pdf51.

8.1.3 Truck V2I/Smart Roadside. Public and public-private sector approaches to ITS for freight and cargo operations have typically used vehicle to fixed infrastructure-oriented telecommunications (V2I). Solutions depended generally upon some form of RFID tags on vehicles and reader/writers tethered to specific locations, such as a toll gate or a highway inspection station. Communication distances could vary from several meters to perhaps 100 feet. The Smart Roadside Initiative was introduced in 2008 to develop an overall Smart Roadside concept of operations and prototypes of the applications consistent with the Connected Vehicle program framework. FMCSA and FHWA sponsored four programs and projects for prototype development efforts. These focus areas52 were the following:

- E-Screening involves automatic identification and safety assessment of a commercial vehicle in motion.

- Virtual Weigh Station/Electronic Permitting53 was to develop the foundation for roadside technologies that can be used to improve truck size and weight enforcement.

- Wireless Roadside Inspections involved examining technologies that can transmit safety data directly from the vehicle to the roadside and from a carrier system to a government system.

- Truck Parking Management Information Systems, which helped provide commercial vehicle parking information so that commercial drivers can make advanced route planning decisions.

8.1.4 Dynamic Mobility Applications. The DOT ITS JPO initiated the Dynamic Mobility Applications (DMA) Program in 2009, as part of the Mobility Program to “expedite the development, testing, commercialization, and deployment of innovative mobility applications, fully leveraging both new technologies and Federal investment to transform transportation system management, to maximize the productivity of the system and enhance the mobility of individuals within the system.”

In 2011, the DMA Program concluded Phase I, which focused on data definition, technology application identification, and demonstration planning. The DMA Program began a second phase and partnered with the research community to further develop high-priority transformative concepts and to refine data and communications needs.

- FRATIS - The Freight Advanced Traveler Information System (FRATIS) was piloted for integrating data sources to improve the productivity of freight moves, or drayage, to and from ports. A drayage optimization application combines container load matching and freight information exchange systems to provide real-time information on container status and pickup/delivery appointments at port terminals. A freight-specific dynamic travel planning application includes traveler information, dynamic routing, and performance monitoring elements, including real-time traffic conditions, incident alerts, work zones, weather delays, road closures, routing for hazardous materials, weight restrictions, port terminal queue status and wait times, and real-time speed data from fleet management systems.

USDOT advanced the FRATIS bundle from concept formulation (completed in Phase 1 of the DMA program) to prototype development and small-scale prototype testing by conducting three small-scale prototypes from 2012 to 2015 in Los Angeles, Dallas/Fort Worth, and South Florida. FRATIS provided traveler information, dynamic routing, load matching, and freight information exchange systems to optimize daily operations planning at drayage companies, including establishing connections with existing public (e.g., regional ITS) and private (e.g., terminal queue, appointment times) sector systems. An independent assessment was conducted for the prototypes that documented findings and lessons learned from the three pilots.

What the FRATIS test provided was a proof of concept that advanced information about queue lengths could help dispatchers adjust their truck departures to avoid long queues, and that advanced departure information from dray companies could be useful to terminals in planning their operations. During the time of the FRATIS prototype test in LA, the queue time was the worst in years and inputs from various stakeholders in LA indicated that FRATIS by itself could not actually reduce terminal queue time. While FRATIS was underway, there were important studies about port congestion that explored port congestion, including queue time, in more detail.

- DrayFLEX - As an indication of how ITS research aids future development, there were 2017-2019 follow-up efforts partly funded by USDOT in the LA area to demonstrate and implement FRATIS-related technologies to improve port congestion and drayage operations. The Los Angeles County Metropolitan Transportation Authority (LA Metro) undertook the FRATIS Modernization project, now rebranded as Drayage, Freight, and Logistics Exchange (DrayFLEX). DrayFLEX builds on the previously mentioned ITS JPO FRATIS efforts to optimize drayage movements, including the exploration of CV technology applications. It will provide freight-specific dynamic travel planning information in order to optimize container movements in and around the Ports of Los Angeles and Long Beach.

DrayFLEX will use information from the trucking companies and traveler information systems to provide status updates on container availability, enabling trucking companies to set up automated appointments, and providing truck drivers the best routes to use to and from the maritime ports. Called DrayFLEX-Trip, the mobile app is described at https://www.itscalifornia.org/Content/AnnualMeetings/2021/Session%202%20LA%20Metro%20-%20DrayFLEX%20Alegre.pdf54.

- TIDC - In 2017, as part of a cooperative agreement between USDOT and TxDOT called the Texas Corridor Optimization for Freight (COF) program, FRATIS technology was used to enhance TxDOT I-35 Traveler Information During Construction (TIDC) system. A pilot test was conducted with two trucking firms operating on I-35 to look at improved automated construction delay and closure notifications to drivers. The results of the pilot test were documented in a September 2018 USDOT report titled “I-35 Freight Advanced Traveler Information System (FRATIS) Impacts Assessment - Final Report #FHWA-JPO-18-694.”

8.1.5 CVISN Core and Advanced Deployment Program. Federal, state, and other governmental bodies are concerned about the safe operation of commercial vehicles; efficient, effective administration of credentialing programs; and enforcement of highway weight limits. The Commercial Vehicle Information Systems and Networks (CVISN) program during the 20002015 period, was USDOT’s central ITS CVO program. CVISN was replaced by the Innovative Technology Deployment (ITD) program at FMCSA which includes safety assistance grants funded by FAST Act. See https://www.fmcsa.dot.gov/itd55. CVISN helped spawn at least two successful public-private ITS CVO programs—PrePass and PierPASS that continue to be used by a number of states and carriers to address safety inspections. All major inspection sites in each state use standard formats to report data directly or indirectly to FMCSA.

- PrePass - is an ITS that electronically verifies the safety, credentials, and weight of commercial vehicles at participating state highway weigh stations, commercial vehicle inspection facilities, and ports of entry. The PrePass Safety Alliance, a non-profit public-private partnership of state agencies and trucking industry leaders, administers the program which reduces traffic congestion, improves carrier safety practices, and promotes safer roadways by electronically screening and bypassing only the safest, most qualified fleets. Truck operators purchase a bypass mobile app and an RFID transponder. For up-to-date information about PrePass, see https://www.prepassalliance.org/56

- PierPASS - is a program, started in 2005, at the ports of LA and Long Beach to help relieve port congestion. It started as an off-peak hour incentive and was restructured in 2018 to a two-shift appointment system which helped reduce queues of trucks at the terminal gates. The appointment system involves the 12 marine terminal operators at LA and Long Beach. See https://www.pierpass.org/about/offpeak-2-0/57

8.1.6 Electronic Freight Management. USDOT’s Electronic Freight Management (EFM) Initiative applied web technologies that improved data and message transmissions between supply chain partners. It promoted and evaluated innovative e-business concepts, enabling process coordination, and information sharing for supply chain freight partners through public-private collaboration. The EFM Initiative’s goal was to advance open source solutions for small-and medium-sized users and consisted of non-proprietary open network architectural specifications using Universal Business Language (UBL) standards, publicly-available web services, and a Service-Oriented Architecture (SOA). EFM focused on automated data exchange among supply chain partners over the Internet. These specifications and standards were used in a series of deployment tests.

- The Columbus EFM project in 2007 was a successful, 6-month deployment test of web services and automated data exchange in an air cargo supply chain of The Limited Brands (LB) from Guangdong province in southern China to Columbus, Ohio. Freight for two of the LB’s business unit supply chains was trucked into Hong Kong, transported via air cargo charters to Rickenbacker Airport in Columbus, Ohio, and then trucked to LB’s distribution centers in Columbus. While the test involved air cargo, the emphasis was on data exchanges and automated status reporting that could be applied to any and all modes as well as to other shippers and the 3PLs that performed logistics services for them. An independent evaluation of the Columbus test showed positive results for all supply chain partners involved, although there was no follow-on implementation of EFM by any of the test participants.

Columbus partners said the most important benefits may be for small to medium-sized shippers and 3PLs who at the time used fax, email, or telephone for the majority of their communications with their supply chain partners and who did not want to assume the costs associated with implementing existing data exchange formats such as EDI; the test partners said conducting the electronic data exchange via EFM should be less costly compared to EDI.

The EFM implementation case studies that were funded and kicked off in 2009 were intended to examine the degree to which the EFM applications could improve the operational efficiency within intermodal supply chains. Each case study documented the cost-effectiveness, long-term viability, and sustainability of the EFM package, as it was modified and implemented within the supply chain. For more information see https://rosap.ntl.bts.gov/view/dot/4036/58

Perhaps what is most important about two of the case studies is that the EFM implementation continued to be operated after the test. In the Interdom-Pride Logistics case study, Pride made EFM its long-term solution. It changed the way Pride does business and the way Pride interacts with its customer (Interdom). In the second example, the case study provided Express Systems Intermodal (ESI) an opportunity for ESI to automate the invoice transaction with one of its more manual dray carriers, Hammer Express.

- The Cross-town Improvement Project (C-TIP) was an effort sponsored by FHWA that was somewhat similar to Electronic Freight Management. Kansas City is the second largest rail hub by tonnage in the nation after Chicago; it has significant volumes of cross-town intermodal handoffs by truck between western and eastern railroads, as well as local deliveries to industry. This activity requires cross-town dray truck trips between railheads and from intermodal terminals to shippers around the region. An initial C-TIP system59 was developed and deployed in Kansas City for a four-month period from October 2010 through January 2011. A deployment test followed in Chicago to assess the potential for truck bobtail move reduction using wireless technologies within several of the C-TIP components.

8.2 Truck platooning.

The 2015 update of this module as well as Module 15 discussed truck platooning. Trucks equipped with cooperative adaptive cruise control and video and radar use V2V communications to control speed and braking as the two or more trucks travel in a convoy. The ITS allows the trucks to travel more closely together, saving fuel and using technology to avoid collisions and thus improve safety. Peleton Technology, Inc. played a lead role in defining this Society of Automotive Engineers (now called SAE International) (SAE) Level 1 (L1) technology 5-10 years ago and received USDOT funding to advance and test the technology. It did pilots in Nevada and a few other places both to advance the technology and to promote a concept of a national operations center that could help identify potential platooning partners.

Meanwhile, governments and truck manufacturers in Europe conducted several on-road tests with as many as six following L1 trucks in a program called Enabling Safe Multi-Brand Platooning for Europe (ENSEMBLE), which also developed specifications for platooning data exchange and operations (see https://platooningensemble.eu/)60.

Source: USDOT

Representatives from the FHWA and ENSEMBLE groups established a twinning arrangement in 2018 that allows the groups to coordinate and exchange information on their parallel research questions. The included consideration of platooning specifications developed by ENSEMBLE for use in U.S. platooning developments. As further described in an ITE Journal article titled “Preparing for Safe and Successful Truck Platooning on Public Roads: Collaboration between the United States and the European Union,” FHWA conducted behavioral interviews and surveys with other drivers about how they perceive single and platooning trucks on U.S. highways. They found that other drivers are largely unfamiliar with the term “platooning” and more often use the term “convoy.” The other drivers reacted favorably to both truck-mounted and roadside signage that indicates a platoon is operating. The results will help governments and the industry in moving forward on truck platooning.

USDOT is sponsoring an L1 platooning field test led by California PATH at the University of California with Roly Trucking company in California where two or three trucks will platoon with real loads in revenue service on I-10 between California and Texas, collecting operations and safety data on the 1,400-mile route during the approximately one year deployment scheduled to begin in March 2022. The deployment will involve 20 different drivers and cross four states. This operational demonstration requires coordination with the state governments involved, will involve operations at night as well as day, and a variety of Southwest U.S. weather conditions. The extensive data collection will include driver-related data about attentiveness and drowsiness and will involve data comparisons with a fourth truck traveling separately with the platoon. The deployment was discussed in several presentations at the Transportation Research Board’s (TRB’s) ARTS21 virtual symposium and a recent ITS conference in Arizona (Emerging Freight ITS and CAV Developments in the Southwestern U.S. by Mark Jensen September 30, 2021). Future platooning research, including driverless following trucks, is discussed in section 10.2.

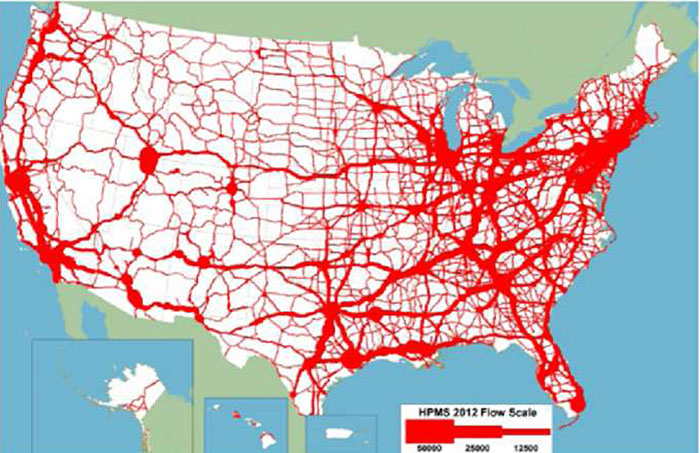

Truck congestion map. Source: FHWA.

8.3 Freight information and data sharing.

The Freight Analysis Framework (FAF), produced through a partnership between BTS and FHWA and now in its 5th edition, called FAF561, integrates data from a variety of sources to create a comprehensive picture of freight movement among states and major metropolitan areas by all modes of transportation.

At the heart of FAF5 is the BTS Commodity Flow Survey (CFS) that is compiled every 5 years. The most recent CFS is for the year 2017 and primarily covers the mining, manufacturing, and wholesale sectors. FAF integrates additional data to estimate volumes of shipments from industries that are not covered by the CFS, including foreign trade. The CFS provides the building blocks for the FAF:

- Over 70 percent of FAF5 freight flows by value are directly from the CFS

- Definitions for FAF’s 132 domestic regions

- Standard Classification of Transported Goods (SCTG) commodity coding scheme, used at the two-digit level for FAF, and FAF mode classifications

- Other major data sources for the FAF5 include Census Foreign Trade Statistics, Economic Census data, Department of Agriculture’s Census of Agriculture, Vehicle Inventory and Use Survey (VIUS), National Highway Planning Network (NHPN), Highway Performance Monitoring System (HPMS), Energy Information Administration (EIA), and other industrial data

FAF5 includes a downloadable dataset with updated origin and destinations for 2017. Through the cooperative work at FHWA and BTS, FAF5 30-year forecasts and FAF5 estimates of truck flows on the highway network and other mapping products are also produced. The FAF5 user’s guide is available at https://www.bts.gov/faf62.

FAF5 is used extensively by state DOTs and researchers and is a basis for some commercial freight movement database products such as Transearch. Although FAF5 covers all of the United States, it is not necessarily at the level of detail that some regional or metropolitan analysts may wish. There are frequent presentations and discussions at TRB Freight Data Committee meetings and workshops of innovative and productive data analyses that transportation researchers have conducted, usually starting with FAF5 or its predecessors. More information about freight data is available at https://www.mytrb.org/OnlineDirectory/Committee/Details/333263; the third Innovations in Freight Data Workshop was completed in September 2021 and included several presentations that, as a minimum, will be covered in printed proceedings of the workshop when published by TRB.

8.4 FHWA Freight Management and Operations program.

The purpose of the program in FHWA’s Freight Office is to “promote the deployment of technology and the adoption of best practices to facilitate the smooth flow of goods on the Nation’s transportation system and across our borders.” There are several key ITS-related programs in addition to various funding programs to aid states and the industry in exploring and demonstrating new technologies:

- Freight Data and Analysis

- Freight Planning, Program Development, and Partnerships

- Freight Flow Modeling System Conditions and Performance Measurement

- Freight Research related to network efficiency and automation

More information can be found at https://ops.fhwa.dot.gov/freight/about.htm64.

8.5 FMCSA Commercial Vehicle Safety Research.

Working together with the trucking industry, FMCSA conducts research into smart technologies that support the expanding role of the trucking industry to safely, securely, and efficiently transport the nation’s goods and products and to better understand the causes of crashes. The mission of FMCSA’s Office of Analysis, Research, and Technology is to reduce the number and severity of commercial motor vehicles-crashes and enhance the efficiency of truck operations by doing the following:

- Providing data, producing statistics, and conducting systematic studies directed toward fuller scientific discovery, knowledge, or understanding

- Identifying, testing, and supporting technology transfer activities and deployment of CMV safety technologies

Source: USDOT.

Information about FMCSA’s current and past research projects can be found at https://www.fmcsa.dot.gov/safety/analysis-research-technology65.

8.6 Current Freight Research Grants.